The 3 changes you need to know – which will affect your ability to get a mortgage and even a credit card.

Australia is looking at a once in a generation chance to reshape how the lending assessment works.

The three biggest drivers of this will be the changes to:

- How credit cards are assessed,

- Open banking standards; and

- The implementation of Comprehensive Credit Reporting (CCR).

So, what you say…but here’s how these changes are simple, but drastic.

2019: Credit cards

Credit card providers will need to assess eligibility based on being able to service the full card limit (e.g. $10,000) in three years rather than just the minimum monthly payment of 2%.

A person who would have previously been eligible for a $25,000 limit in 2018 (under an MMP of 2%) will now only be able to access $13,000 from January 2019.

And if you cancel a credit card for some reason, you may well find yourself immediately rejected for a new one. Especially heed this if you’re over 50.Let’s not forget any denied applications – credit card or mortgage – also push down your credit score.

2019: The real effect of CCR

Currently, credit reports are used as part of making credit (lending) decisions on home loans only use ‘negative’ information about a customer’s credit history, for example credit enquires with other lenders, payment defaults, bankruptcies, court orders and judgements.

Australia has now adopted positive credit reporting. Lenders will have access to a deeper, richer set of data enabling them to better assess a borrower’s true credit position and their ability to pay a loan. Because of this measure it may mean you see a change in your credit score within the coming months. Remember, every month information is captured on whether or not you have paid your loan and credit cards on time. How many credit/lending enquires you have had, how many accounts you have opened and closed…

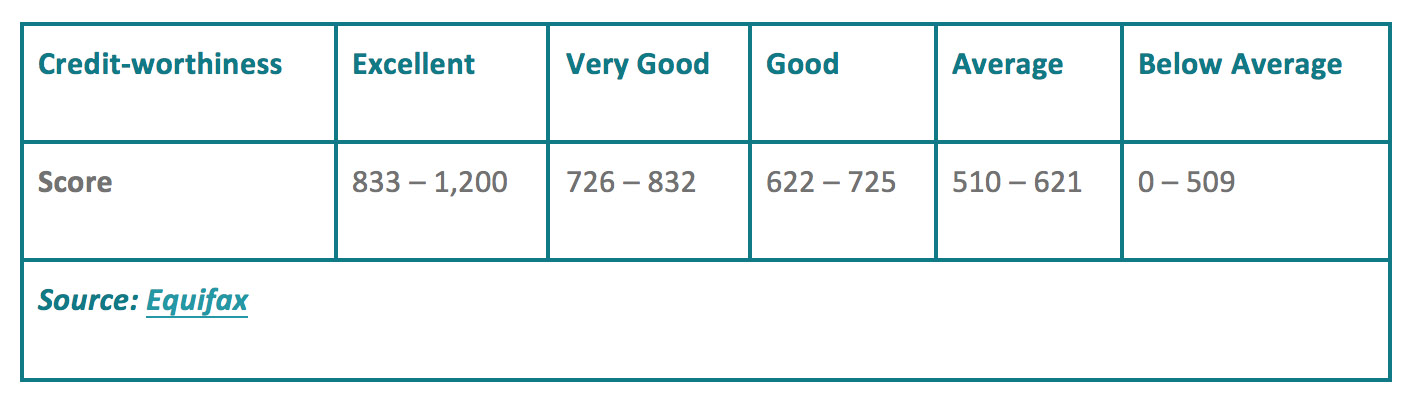

What is a good credit score? Your credit score will be arranged into five different bands, with each band representing a level of credit-worthiness to the lender:

- Excellent (833-1,200) means that you are in the top 20% of the credit-active population using Equifax – you are seen as highly unlikely to experience a default or bankruptcy within 12 months. You have a five-times better than average chance of keeping a clean credit report and can be more likely to receive approval for credit products.

- Very good (726-832) means you are seen as unlikely to experience a default or bankruptcy in the next 12 months, and you are among the top 21-40% of the Equifax population when it comes to credit trustworthiness.

- Good (622-725) means you are seen as less likely than average to experience a default or bankruptcy and have a better than average chance of keeping a clean credit score, but it could do with improvement.

- Average (510-621) – while not sounding like a worrying label, according to Equifax, being in this band means an adverse event such as a default is ‘likely’ in the next 12 months when compared to the other parts of the Australian population.

- Below average (0-509) means you’re in the bottom 20% of the credit-active population and are unlikely to be approved by reputable lenders.

Essentially, the higher your credit score, the less likely it is that lenders will think an adverse event (such as a missed payment) will happen within the next 12 months, and you could have a higher chance of being approved for loans and other credit-based products.

What can I do? tips to get ready for Comprehensive Credit Reporting are:

- Consider setting up direct debits to help ensure bills are paid on time

- Be careful about constantly switching credit card providers

- Notify your credit providers of your new address when you move

- Research thoroughly before applying for credit and only apply when you really need it

- Protect your identity from fraud

- Monitor your credit score regularly. You can access a free check from this link credit report

2019: Open banking begins

Open banking standards are being phased in 2019 making it easier for you to switch banks and get a better-deals. All your digital information on your transaction accounts and lending will be available to you to assess different solutions and banking packages.

With your permission, this information is also available to all lenders too.

Banks currently look at grocery bills, medical expenses and utility bills to assess a borrowers’ household expenses and their ability to meet their repayments.But under the proposed changes, customers’ digital spending habits like their Uber Eatsor online shopping history could be fair game when it comes to getting approved for ahome loan.

You will need to review and have a plan for when you apply for a home loan. Remember, banks will have access to your transaction history. They may determine you cannot afford the loan you are applying for, when they troll through your transaction history. If they decline your loan based of this review, it will stay on your credit report for 5 years (and your digital transaction history for 2 years).

For more information

Please speak to our team at Breakfree Financial Solutions. They will provide expert advice and guidance to find a solution at the best price available without the hassle of applying yourself.