Australian banking regulator (APRA) announced plans this week to relax the assessment rate for home loans, effectively meaning home buyers could access and/or borrow more money. Industry figures described it as the most significant development for the property market “in at least four years”.

The 2 key aspects banks consider when approving a loan are 1st way out (serviceability) and 2nd way out (equity – preferable 20%). If you pass both tests, then your loan is approved. All sounds simple, but what people don’t appreciate in a low-interest rate environment where owner-occupied home loans are ~ 3.9% p.a. is serviceability is actually assessed on a lending rate of ~ 7.25% p.a. Serviceability assessments are used to make sure borrowers can repay their loans under different circumstances: for instance, if banks have to increase mortgage rates. It is reasonable to expect interest rates to fluctuate over a 30-year term.

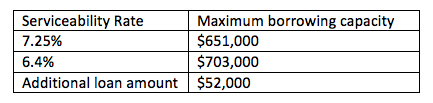

The positive impact of APRA’s proposed change will see banks able to review and set their own interest rate for serviceability testing. It is widely expected that the serviceability test will be 2.5% above the actual interest rate. Using the scenario if someone is looking to borrow at 3.9% they would be assessed on their ability to repay at a lower 6.4%, rather than 7.25%.

Let’s look at an example of what that means for a couple with 2 children, a combined salary of $150,000, with average monthly spend of $5,500

Overall the change is welcomed and will help some borrowers that can’t quite access a mortgage currently to get one. This proposed change in conjunction with the uncertainty of the election now behind will potentially provide additional positives for the housing market. However, according to CoreLogic, it expects to the property market will bottom in mid-2020 and they aren’t forecasting a rapid rebound. Furthermore, this change may also ease some of the urgency for official interest rate cuts by the Reserve Bank. If housing can provide some additional economic stimulus, rate cuts may be less necessary.